“Superhero landing. She’s gonna do a superhero landing. Wait for it.” – Deadpool

What’s more than step 9, but not quite to step 10? This clock.

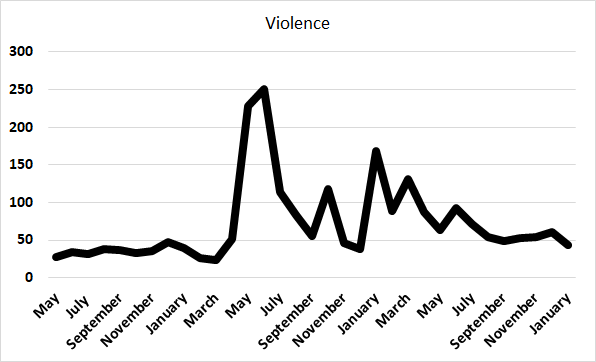

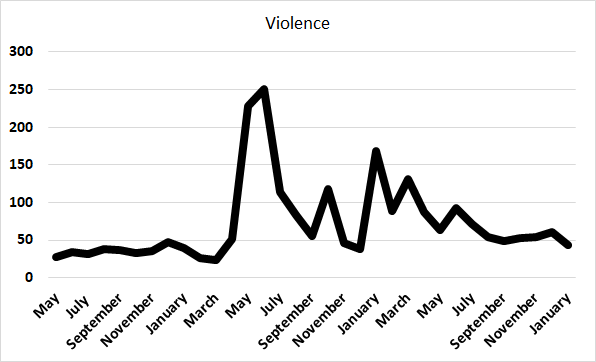

- Common violence. Organized violence is occurring monthly.

- Opposing sides develop governing/war structures. Just in case.

- Common violence that is generally deemed by governmental authorities as justified based on ideology.

- Open War.

As close as we are to the precipice of war, be careful. Things could change at any minute. Avoid crowds. Get out of cities. Now. A year too soon is better than one day too late.

In this issue: Front Matter – The Jenga® Civil War – Violence And Censorship Update – Updated Civil War 2.0 Index – Lessons From Canada – Links

Front Matter

Welcome to the latest issue of the Civil War II Weather Report. These posts are different than the other posts at Wilder Wealthy and Wise and consist of smaller segments covering multiple topics around the single focus of Civil War 2.0, on the first or second Monday of every month. I’ve created a page (LINK) for links to all of the past issues. Also, subscribe because you’ll join nearly 640 other people and get every single Wilder post delivered to your inbox, M-W-F at 7:30AM Eastern, free of charge.

https://wilderwealthywise.com/civil-war-weather-report-previous-posts/

The Jenga™ Civil War

The game of Jenga© has been pretty popular in the United States since it was introduced into the United States. The object of the game should be familiar to most – build a tower taller and taller until it falls. It always falls. Someone tips the table, someone pulls out the one piece that shouldn’t come out, or Islamic terrorists decide to fly a chicken wing into it.

But Jenga™ illustrates something else. If you keep increasing the instability of a structure, it will fail. It’s an when, not an if. Jenga® doesn’t end until the tower falls over, and each pull and replace of a piece reduces stability.

As found on the Internet.

What causes the collapse?

It doesn’t matter, unless you’re the player that does it. What matters are the conditions. As I’ve tried to do below with the graphs, I’ve tried to create a barometer for conditions that might lead to Civil War. And, no, we’re really not there yet. Is the blood flowing? Certainly.

Are both sides engaged? Certainly not. That’s what scares the Leftists in Washington, D.C. to no end. The idea that people on the Right will engage in a strategic sense to start and end the phase of open-armed warfare keeps them up at night.

And it should. But, again, it’s not the spark. Historians in the future will write about the spark, but the spark would have no effect if the conditions weren’t there. What are the conditions? You know them, you feel them. There is no sense of who and what we are anymore.

As found.

As a nation, we have no goals except what hedonism can be sold to us weekly. It’s what’s streaming, what’s playing, and what new McFood© is coming out this week. Commercial activity can’t be the binding for a nation, so our ties are just as tight as those Jenga™ bricks, kept together by gravity, inertia and little else.

And every week the tower gets one brick higher.

Think Joe’s not taking this seriously?

Violence And Censorship Update

Again, not much on the organized violence this January. Censorship, as usual, is busy.

Rogan

Joe Rogan is a podcaster who has managed to become slightly more popular than me. His podcasts regularly pull 11,000,000 listeners. Rogan also was big enough to get serious A-list quests. All of that made Spotify® decide that Rogan is valuable. How valuable? They pay Rogan more than they pay for every bit of music that they stream. Yes. Joe Rogan is more important to Spotify© than all of the recorded music in the history of the world. He’s worth $100,000,000 to them.

And he’s said things that irritate people invested in the Narrative. He’s not vaxxed, and has (like your humble host) had the ‘VID. He took Ivermectin. I got by with chicken soup and loads of decongestant. I’ve never been much to listen to Joe, I’ve probably only heard a few minutes (in total) of his podcasts.

They’ve been after Joe, and it started with Neil Young. Despite being less relevant than greased back Fonzie hair, Neil made the papers with his demand that his music be pulled off of Spotify© because Joe Rogan said things he didn’t agree with. Then other, equally irrelevant artists followed stamping their walkers to demand that Spotify® not play them to the one person that asks for their song every six months.

As found.

That was just the start. Someone has now have gone back through Rogan’s early podcasts and have a supercut of him saying the only word that is now taboo for some people to say. Rogan has now apologized, which is the first mistake, and now his blood is in the water. What happens next?

Who can say?

DOJ

On January 11, the Department of Justice announced a new domestic terrorism task force, because “We have seen a growing threat from those who are motivated by racial animus, as well as those who ascribe to extremist anti-government and anti-authority ideologies.”

I’m not jumping on a limb and being Nostradamus by betting that it’s nearly certain that the people who started CHAZ as an avowed foreign nation won’t be prosecuted. But if someone tries to lead a trucker’s strike like in Ottawa? You can bet that the DOJ, FBI, NSA and every other three-letter agency will be on them. Because terrorism really only applies to things the Right does.

Updated Civil War II Index

The Civil War II graphs are an attempt to measure four factors that might make Civil War II more likely, in real time. They are broken up into Violence, Political Instability, Economic Outlook, and Illegal Alien Crossings. As each of these is difficult to measure, I’ve created for three of the four metrics some leading indicators that combine to become the index. On illegal aliens, I’m just using government figures.

Violence:

Violence is down. January isn’t (usually) a big month for violence, so that’s to be expected. I would expect the next few months to remain calm as well, perhaps turning back up in April.

Political Instability:

Up is more unstable, and it’s headed upwards, fast. Joe has lost his base.

Economic:

The drop in economic confidence continued this month. Expect a bigger drop this month. The economy is falling apart.

Illegal Aliens:

This data was at record levels for this time of year. All-time record levels. Plus? Airflights for illegals. No DOJ task force for this . . .

Lessons from Canada

Canada has lived under very strict fear COVID restrictions. Trudeau has recently tightened the restrictions, especially with respect to truckers. You can look up the details, but to summarize: it was the last straw for many truckers.

As found, though in this case I don’t think he’s up to invading an ice cream store.

Truckers have a unique place in society. They provide that final lifeline on everything from the chlorine that the water treatment plant uses to food at Wal-Mart® to the toilet paper that everyone panic-bought in 2020. Many of them also own their own trucks. They work when they want to as owner operators.

As found.

Make them mad? Right now, hundreds of Canadian truckers have had enough, and are occupying Ottawa. How serious is Justine Trudeau taking this? He vanished like Saddam Hussein, but with better press coverage. He ran away, and left the Leftists of Ottawa to their own devices.

As found. I wonder what will happen to Justine’s son, Uday?

And they are upset. Apparently, their cats are of the very sensitive type (memes as found):

Also, the Leftists tried to set up a counter protest. /POL/ got into their communication channels, giving conflicting starting and ending times for the protest, and filling the protestors up with doubt, “Boy, that sure seems like a long time to protest, and it’s going to be cold out there. Don’t forget to dress in layers! I’ll be with you in spirit!”

As a lark, it has been a lot of fun for the Right, and already two provinces (they’re like states, but made of maple syrup) have indicated that restrictions are going away soon in those provinces. The convoy is working.

As such, the Ottawa police is now trying to crack down on the logistics of the truckers. Will it work? Maybe. Maybe not.

I think two lessons are that this will never, ever be allowed in the United States in a major Leftist city and will be censored by the major news media working in concert with .gov if it ever starts to develop. The crackdown would be ruthless, especially if it occurred in D.C. Leftists are as afraid of actual workers as they are of actual work.

As found. Also, Leftist logic thought process.

LINKS

As usual, links this month are courtesy of Ricky. Thanks so much, Ricky!!

Bad Guys (Jan 2022)…

NYC: https://twitter.com/i/status/1478006188856025097

NYC: https://twitter.com/AndrewPollackFL/status/1482023373165285379

Chicago: https://youtu.be/U1G2Gt loP0

Chicago: https://www.youtube.com/watch?v=IDN4S-mhplk

Detroit: https://youtu.be/C8ePWbzYTP8

Detroit: https://youtu.be/jv0LvsphFSA

Portland: https://youtu.be/TKnXY3pZWK8

LA: https://twitter.com/streetpeopleLA/status/1484350084439363586

LA: https://twitter.com/streetpeopleLA/status/1484356560956526593

San Jose: https://youtu.be/MfjkUJZFbl0

SF: https://twitter.com/i/status/1479164420148248576

Good Guys (Jan 2022)…

https://www.dailymail.co.uk/news/article-10402917/Two-teens-charged-murder-subway-attack-Good-Samaritan-killed.html

https://6abc.com/philadelphia-carjacking-driver-shoots-carjacker-fairmount-west-kensington/11452980/

One Guy

https://www.wpr.org/gun-kyle-rittenhouse-used-kenosha-shootings-be-destroyed

https://www.dailywire.com/news/kyle-rittenhouse-sits-down-with-candace-owens-discusses-future-plans-theres-going-to-be-some-accountability

Body Count (Jan 2022)

USA Surge 2021: https://invesbrain.com/states-investigating-surge-in-mortality-rate-among-18-49-year-olds-majority-unrelated-to-covid-19/

https://thelibertydaily.com/bombshell-cover-up-cancer-diagnoses-in-the-military-rose-over-three-fold-since-jabs-were-introduced/

USA Fentanyl 2021: https://secureservercdn.net/166.62.108.196/w7l.6b7.myftpupload.com/wp-content/uploads/2021/12/facts.pdf?time=1640209532

USA Weather 2021: https://twitter.com/NOAA/status/1480574295940161536

Chicago 2021: https://cms.zerohedge.com/s3/files/inline-images/violence.png?itok=BmL3yEVn

NYC 9 Days In 2022: https://i.dailymail.co.uk/1s/2022/01/11/05/52781909-10389089-image-a-8_1641877588156.jpg

Philly “Safe Streets Violence Interrupter” : https://www.youtube.com/watch?v=ts6XSYE4zNI

Blacks: https://www.unz.com/isteve/cdc-blacks-died-36-more-often-by-homicide-in-the-year-of-the-racial-reckoning/

Body Count (Snoop Dog “F**k The Police” Super Bowl Edition)

https://nypost.com/2022/01/29/snoop-dogg-at-super-bowl-halftime-show-becoming-even-worse-look/

https://nypost.com/2021/12/29/where-is-the-outrage-over-the-killing-of-keona-holley/

https://nypost.com/2022/01/06/cop-killed-with-own-gun-after-pleading-with-suspect-to-spare-life-prosecutor/

https://www.outlookindia.com/website/story/world-news-chicago-female-police-officer-killed-one-wounded-in-traffic-stop-shooting/390867

https://www.foxnews.com/us/nyc-murderer-first-female-police-officer-paroled

https://jonathanturley.org/2021/12/23/the-potter-verdict-was-the-jury-right-but-the-law-wrong-on-culpable-negligence/

https://www.yahoo.com/gma/police-attacked-least-4-us-110120536.html

https://nleomf.org/wp-content/uploads/2022/01/2021-EOY-Fatality-Report-Final-web.pdf

Polled Lives Matter!!!

https://newsbusters.org/blogs/nb/brad-wilmouth/2022/01/02/did-gallup-end-most-admired-74-year-polling-tradition-avoid-trump

https://nypost.com/2022/01/02/34-percent-of-americans-say-violence-against-government-justified/

https://www.msn.com/en-us/news/politics/1-in-3-americans-say-violence-against-government-can-be-justified-citing-fears-of-political-schism-pandemic/ar-AASld12

https://www.forbes.com/sites/nicholasreimann/2022/01/12/nearly-60-of-americans-worry-democracy-in-danger-of-collapse-poll-suggests/?sh=72ffc315483e

https://www.washingtonexaminer.com/opinion/washington-secrets/democrats-ok-with-fines-prison-mandates-for-vax-deniers-poll

https://www.rasmussenreports.com/public_content/politics/partner_surveys/jan_2022/covid_19_democratic_voters_support_harsh_measures_against_unvaccinated

https://www.theorganicprepper.com/survey-unvaccinated/

THE TRUTH IS OUT THERE

USA (MUST SEE): https://2000mules.com/

GA (MUST READ): https://www.truethevote.org/ttv-statement-regarding-georgia-ballot-harvesting-investigation/

GA : https://justthenews.com/politics-policy/elections/georgia-opens-investigation-possible-illegal-ballot-harvesting-2020

GA :https://twitter.com/TalkMullins/status/1487299420752334848

GA : https://voterga.org/wp-content/uploads/2022/01/Press-Release-VoterGA-Drop-Box-Custody-Chain-Analysis.pdf

GA : https://www.thegatewaypundit.com/2022/01/huge-georgia-ballot-trafficking-whistleblower-admits-making-45000-stuffing-ballot-boxes-just-one-242-traffickers-possibly-1-million-ballots/

PA: https://thefederalist.com/2022/01/17/video-shows-pennsylvania-official-admitting-election-laws-were-broken-in-2020/

PA: https://www.msn.com/en-us/news/politics/biden-s-nearly-2m-mail-in-pennsylvania-votes-in-2020-would-now-be-unconstitutional/ar-AATfqsq

TX: https://www.sos.texas.gov/elections/forms/phase1-progress-report.pdf

TX: https://www.theepochtimes.com/texas-audit-finds-over-11000-potential-non-citizens-registered-to-vote-other-problems_4188076.html

WI: https://thehill.com/regulation/court-battles/589714-judge-rules-absentee-ballot-drop-boxes-cannot-be-used-in-wisconsin?amp

WI: https://amgreatness.com/2022/01/10/how-a-mark-zuckerberg-funded-nonprofit-turned-wisconsin-blue/

CA: https://ktla.com/news/local-news/no-evidence-of-election-fraud-by-man-found-passed-out-with-300-recall-ballots-drugs-in-torrance-police/

USA: https://www.cnn.com/2022/01/09/politics/gop-election-voting-rights-battleground-states/index.html

USA: https://uncoverdc.com/2021/12/23/heritage-foundation-state-election-integrity-scorecard-puts-georgia-at-top/

USA: https://www.dailywire.com/news/biden-judicial-nominee-said-proof-of-citizenship-is-voter-suppression

They Say It’s Your Birthday…

https://www.dailymail.co.uk/news/article-10391647/FBI-executive-assistant-director-stays-mum-Cruz-asks-agents-participated-January-6-riot.html

https://thehill.com/policy/national-security/588446-division-reins-over-jan-6-anniversary

https://www.ajc.com/news/jimmy-carter-america-on-the-brink-of-a-widening-abyss/2ER2BJ2ZCJGQBBKHLUYSPPMRXU/

https://thefederalist.com/2022/01/17/democrats-are-priming-themselves-to-refuse-to-accept-any-election-defeats/

https://pjmedia.com/news-and-politics/victoria-taft/2022/01/14/actor-nick-searcys-movie-capitol-punishment-is-the-best-doc-about-january-6-hed-know-he-was-there-n1549452

The Night The Lights Went Out In Georgia…

https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/01/11/remarks-by-president-biden-on-protecting-the-right-to-vote/

https://www.nationalreview.com/corner/bidens-disastrous-georgia-speech-threw-away-his-last-chance-to-start-anew/

https://www.dailywire.com/news/mcconnell-blasts-bidens-profoundly-unpresidential-rant-he-propagandized-against-his-own-country

https://www.foxnews.com/media/mike-huckabee-biden-insane-georgia-voting-rights-speech

https://thehiu.com/bidens-georgia-speech-was-a-breaking-point/

https://twitter.com/TulsiGabbard?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1481467050027466752%7Ctwgr%5E%7Ctwcon%5Es1_

https://jonathanturley.org/2022/01/11/democracy-autocracy-or-hypocrisy-biden-to-call-for-curtailing-filibuster-rule-in-reversal-of-long-held-position/

Disco Inferno:

https://thehill.com/opinion/campaign/589888-kyrsten-sinema’s-courage-washington-hypocrisy-and-the-politics-of-rage

http://ronpaulinstitute.org/archives/featured-articles/2022/january/10/we-need-a-revolution/

https://abcnews.go.com/US/oath-keepers-spokesperson-warns-wing-propaganda-dangerous-bullets/story?id=82094999

https://amgreatness.com/2022/01/09/what-makes-riots-conspiracies-cabals-and-insurrections-good-or-bad/

https://www.bbc.com/news/world-us-canada-60036911

https://www.politico.com/news/magazine/2022/01/06/new-civil-war-about-what-exactly-526603

https://www.spiked-online.com/2022/01/12/the-hysterical-fantasy-of-an-impending-civil-war/amp/

https://www.theguardian.com/books/2022/jan/16/the-next-civil-war-stephen-marche-how-civil-wars-start-barbara-walter-review-nightmare-scenarios-for-the-us

https://www.tabletmag.com/sections/news/articles/americas-asymmetric-civil-war

https://www.fastcompany.com/90572489/u-s-election-maps-are-wildly-misleading-so-this-designer-fixed-them

https://cms.zerohedge.com/s3/files/inline-images/Brookings-2economies11-20a_0.png?itok=EO-pIuFl

The End Of The World

https://brucewilds.blogspot.com/2022/01/if-unrest-soars-in-america-will-looters.html